Investment New Markets Tax Credits White Paper

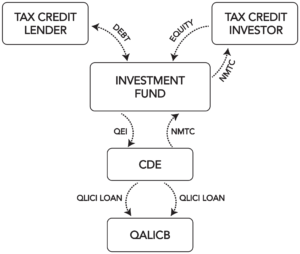

NMTC – The U.S. Treasury’s New Markets Tax Credit program (NMTC), which began in 2000, is designed to spur economic development activity in economically disadvantaged communities throughout the country. Communities often have good, viable business and economic development opportunities, but need access to capital. The NMTC addresses this capital gap by providing the incentive of a Federal tax credit to individuals or corporations that invest in a Community Development Entity (CDE), which in turn invests in the local Qualified Active Low Income Community Business (QALICB).

Key Terms:

CDE – Community Development Entity provides investment capital (NMTC Allocation) to eligible projects in low-income communities

QEI – Qualified Equity Investment is the total of the equity invested into a project

LIC – Low Income Community

QALICB – Qualified Low-Income Community Business is the project company

QLICI – Qualified Low-Income Community Investment is the amount invested by the CDE into the QALICB